Perspectives

Subscribe to receive our latest News & Insights directly in your inbox.

Subscribe Now

Insights

Brokers Profiting from Client Cash Balances: A Growing Concern

August 2024

Recent class-action lawsuits have exposed a troubling trend in the brokerage industry—brokers are making substantial profits from client cash balances while offering clients minimal returns. Historically, brokers would automatically sweep idle cash into money market funds, ensuring clients earned a fair interest rate. Today, many firms have abandoned this client-friendly practice, leaving cash idle or invested in ways that disproportionately benefit the broker.

Insights

What to Know Before the Tax Cuts and Jobs Act Provisions Sunset

July 2024

The Tax Cuts and Jobs Act (TCJA), enacted in 2017, brought significant changes to estate and gift tax laws in the United States. Unless Congress acts to extend these provisions, the estate and gift tax exemptions will revert to pre-TCJA levels, adjusted for inflation. This would result in a significant decrease in the exemption amounts, potentially back to around $6 million per individual.

Insights

Maintaining Calm in the Midst of Crisis

February 25, 2022

The lead-up to this crisis has created market volatility that we haven’t seen in some time. As we know well, if there’s one thing markets don’t like, it’s uncertainty. On the other hand, something else we know well is that geopolitical crises, such as this current situation with Russia and Ukraine, tend to have near-term rather than long-term impacts on the markets and investors.

Insights

Proposed Tax Law Changes from the Biden Administration

June 2021

At the end of April, President Joe Biden released a proposal for changes to the current U.S. tax code in the form of the American Families Plan. This proposal is broad and touches on many areas beyond the scope of the current tax code. However, for the purposes of this update, we will review three portions directly related to current tax law which may materially impact our clients and their families.

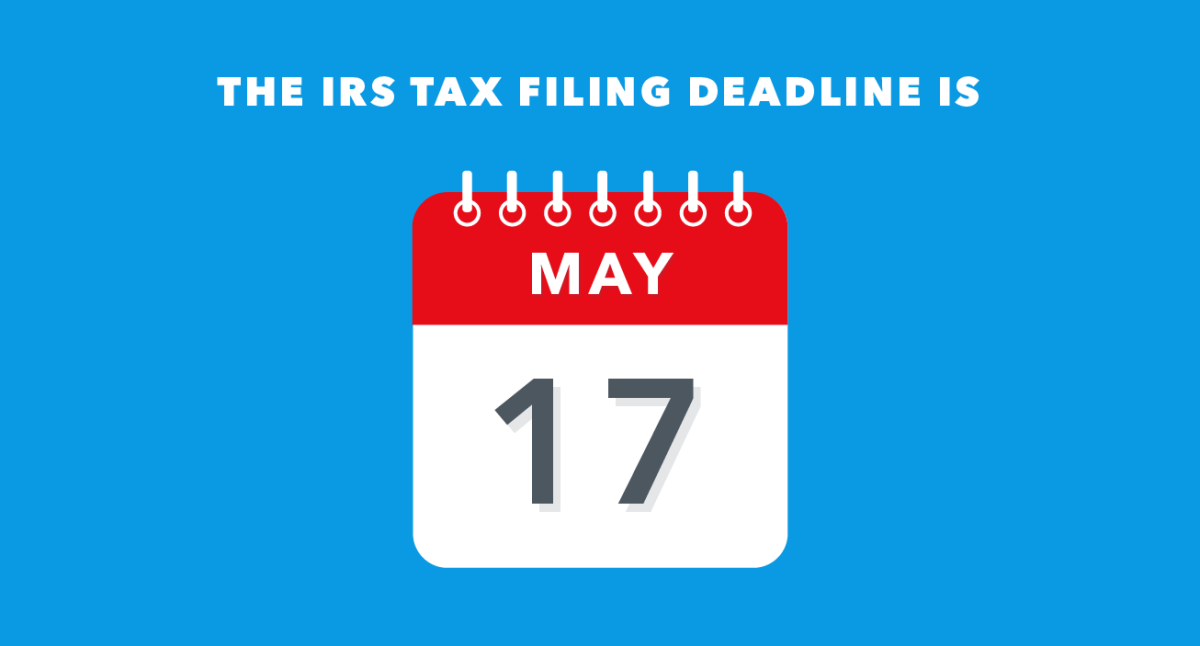

Insights

Changes to Tax Deadlines for 2021

April 2021

The Internal Revenue Service (IRS) recently announced that the filing date for individuals to file their 2020 Federal income taxes has been extended to May 17, 2021. Individual taxpayers do not need to file any forms to qualify for this extension. The extension applies to the filing of Federal tax forms, as well as the payment of any remaining 2020 Federal tax due. The extension allows individuals to postpone tax payments for the 2020 year, which would have been due on April 15, until May 17 without accruing additional penalties or interest, regardless of the amount owed. Penalties and interest will begin to accrue on any unpaid balances as of May 17, 2021.

Insights

Decision 2020: The U.S. Election and the Markets

October 2020

Investors hope a clear and decisive winner will be declared in the presidential election this November. If the election is contested or results are delayed due to record mail-in ballots, we believe investors should expect to see near-term volatility increase in the U.S. stock market. Similar volatility occurred in 2000, after the famous “hanging chad” election that saw a six-week delay before George W. Bush was eventually declared the winner.