Changes to Tax Deadlines for 2021

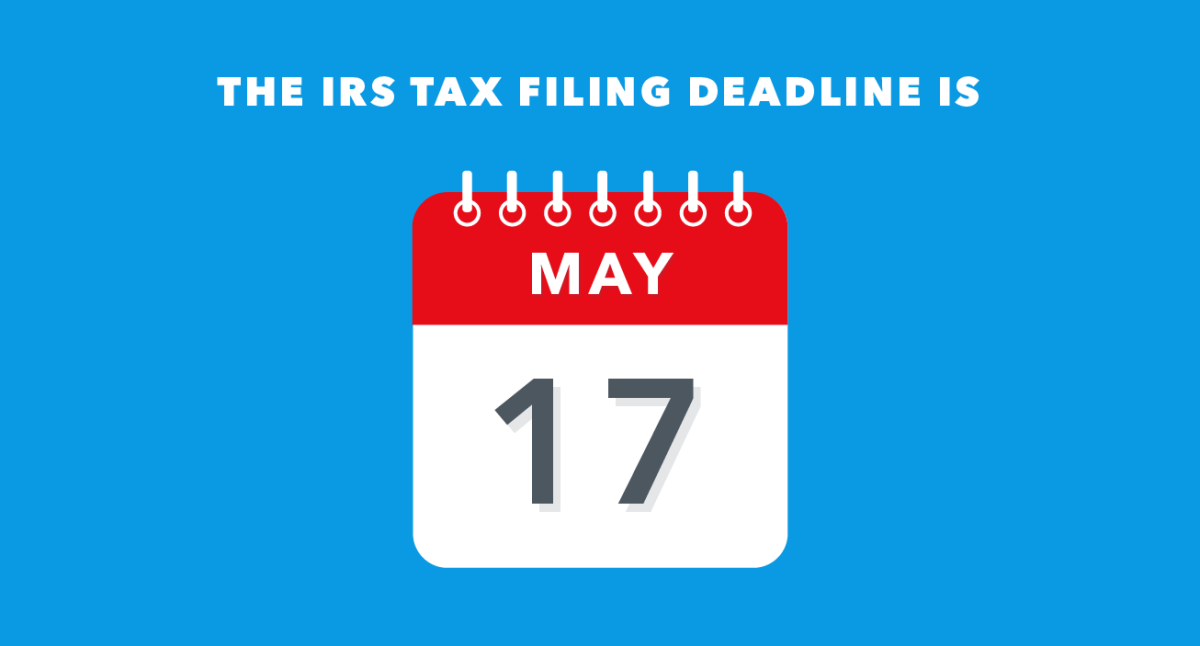

The Internal Revenue Service (IRS) recently announced that the filing date for individuals to file their 2020 Federal income taxes has been extended to May 17, 2021. Individual taxpayers do not need to file any forms to qualify for this extension. The extension applies to the filing of Federal tax forms, as well as the payment of any remaining 2020 Federal tax due. The extension allows individuals to postpone tax payments for the 2020 year, which would have been due on April 15, until May 17 without accruing additional penalties or interest, regardless of the amount owed. Penalties and interest will begin to accrue on any unpaid balances as of May 17, 2021.

It should be noted that this extension does not apply to 2021 estimated tax payments. If needed, those payments are still due by April 15, 2021 to avoid possible interest or penalties. Taxes must be paid as taxpayers earn or receive income during the year, either through withholding or estimated tax payments. In general, estimated tax payments are made quarterly to the IRS by people whose income is not subject to income tax withholding (i.e. self-employment income, interest, dividends, capital gains alimony or rental income).

The May 17 extension granted by the IRS applies only to Federal tax returns and payments. While some states are adjusting their tax deadlines, not all states have issued extensions to line up with the Federal due date of May 17. For individuals living in California, the state tax deadline has been extended to line up with the extended Federal deadline of May 17. As with Federal returns and payments, this allows California taxpayers to delay filings and payments for 2020 taxes until May 17. California 2021 estimated tax payment dates, however, are not extended and Q1 2021 estimates are still due by April 15.

If you are unsure of the tax deadline in your state, we suggest that you check with your CPA, tax advisor or state tax board.