Maintaining Calm in the Midst of Crisis

Starting in late 2021 and throughout all of 2022, Wall Street has debated what markets might do if Russia invades Ukraine. For more than a week, the White House warned that an invasion was imminent. On Wednesday night, Russian military forces began an assault across Ukraine and troops began to move into the country.

The lead-up to this crisis has created market volatility that we haven’t seen in some time. As we know well, if there’s one thing markets don’t like, it’s uncertainty. On the other hand, something else we know well is that geopolitical crises, such as this current situation with Russia and Ukraine, tend to have near-term rather than long-term impacts on the markets and investors.

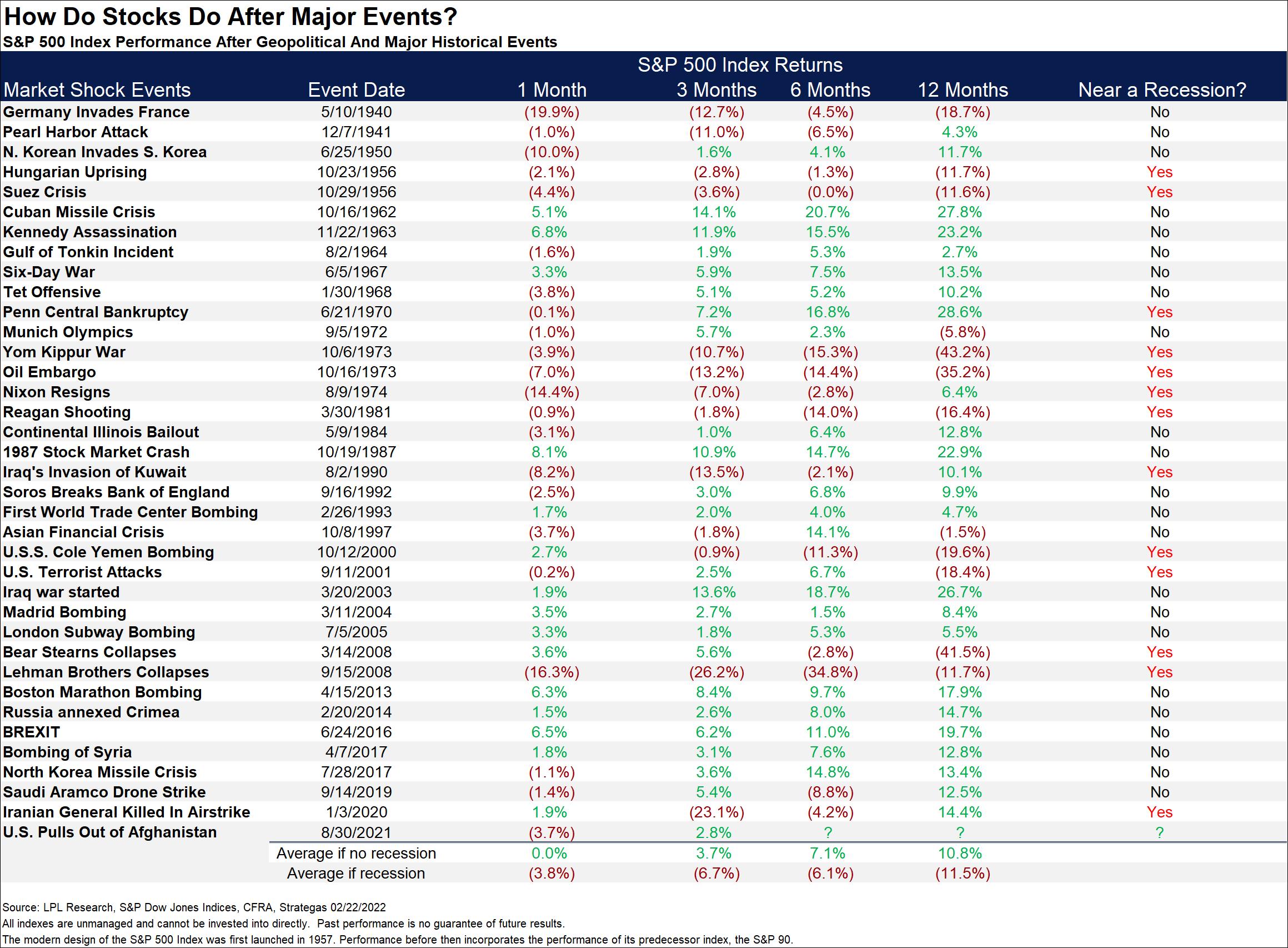

As the chart below from LPL Research shows, while past geopolitical crises tend to have short-term impacts on the stock market, stocks have fared well a year later.

What can we expect in the near term?

We believe market volatility will remain elevated for a number of weeks until we can assess where this crisis is going and if the economic sanctions being placed on Russia by the U.S. and Europe take hold.

The price of oil is hovering around $100/barrel, a level not seen since 2014. Global inventories are already tight, as outlined in a report released on February 11th from the International Energy Agency that warned that the crude market was set to tighten even further. With gas prices already high due to inflationary pressure, we should expect to see prices at the pump rise further.

Russia is also a major supplier of natural gas to Western Europe and the potential exists for natural gas prices to rise significantly due to this crisis.

What should investors do?

At Scharf Investments, we are committed to providing clients with downside protection during adverse market conditions. We do that by investing in high-quality companies that we believe provide compelling valuations, margin of safety, and sustainable and consistent earnings. As of yesterday’s market close, year-to-date performance shows the Scharf Equity portfolio even with the Russell 1000 Value Index and outperforming the S&P 500 Index by 4.19%, and the Scharf Multi-Asset portfolio outperforming the S&P 500 Index by 5.09%.*

When you see dramatic swings in the stock market as we did yesterday, it’s important to remain calm. Talk to your Wealth Advisor, review your financial plan, and determine if your risk tolerance is aligned with long-term goals.

* Past performance is not indicative of future results.