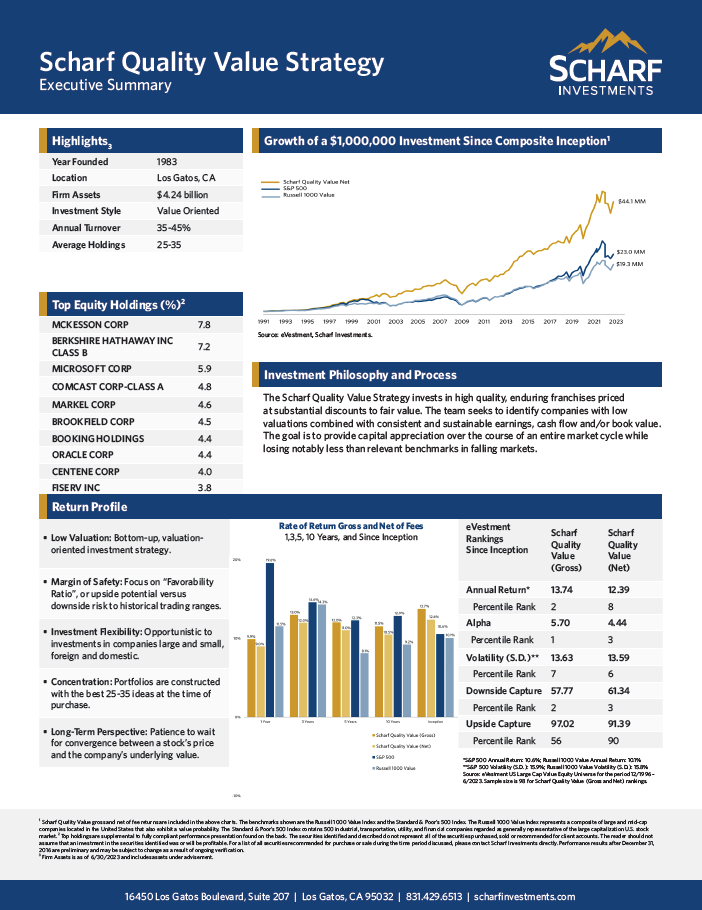

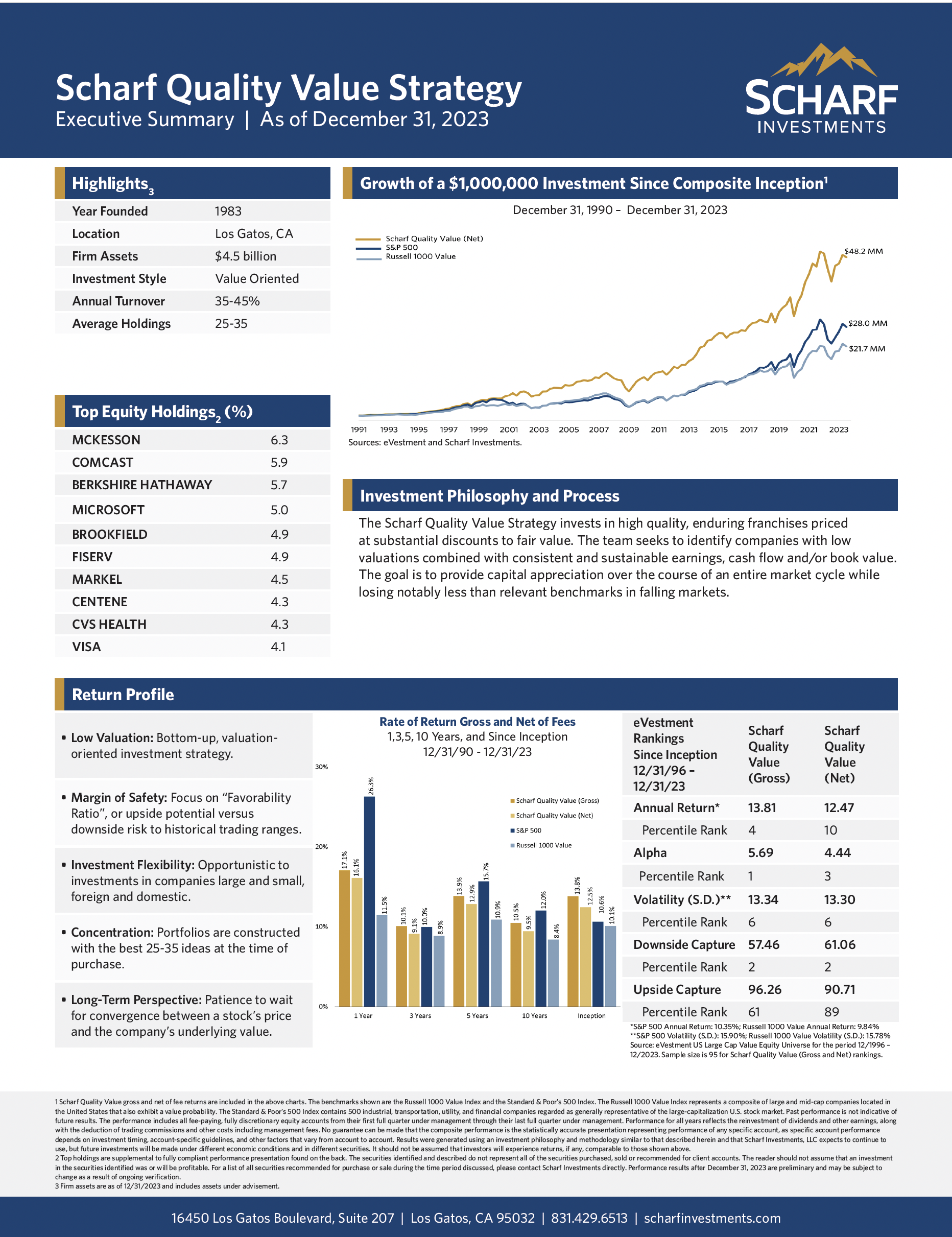

The Scharf Quality Value Strategy invests in high quality, enduring franchises priced at substantial discounts to fair value. The team seeks to identify companies with low valuations combined with consistent and sustainable earnings, cash flow and/or book value. The goal is to provide capital appreciation over the course of an entire market cycle while losing notably less than relevant benchmarks in falling markets.