Brochures

-

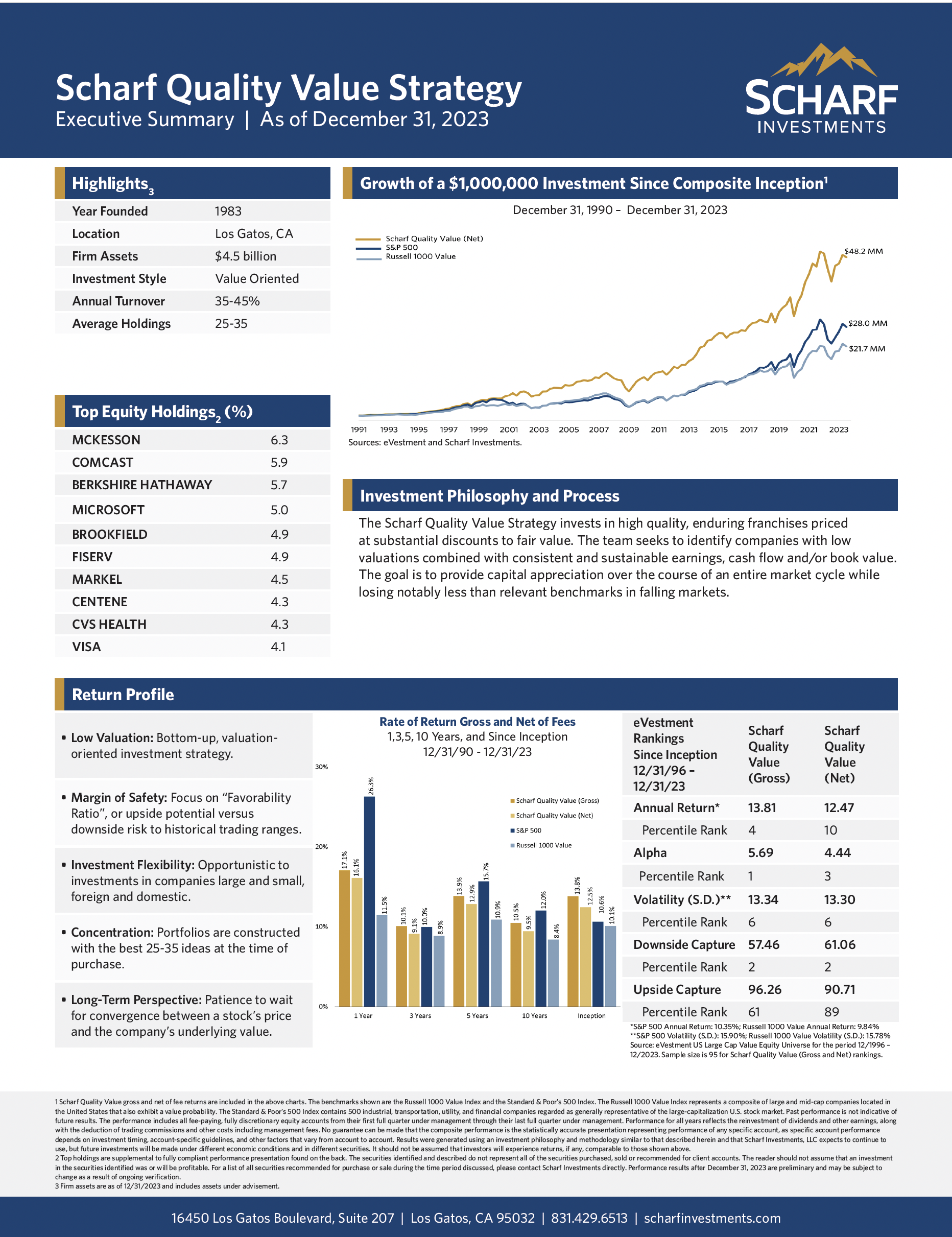

Scharf Quality Value Strategy Q4’23

December 31, 2023 | Brochures

The Scharf Quality Value Strategy invests in high quality, enduring franchises priced at substantial discounts to fair value. The team seeks to identify companies with low valuations combined with consistent and sustainable earnings, cash flow and/or book value. The goal is to provide capital appreciation over the course of an entire market cycle while losing notably less than relevant benchmarks in falling markets.

-

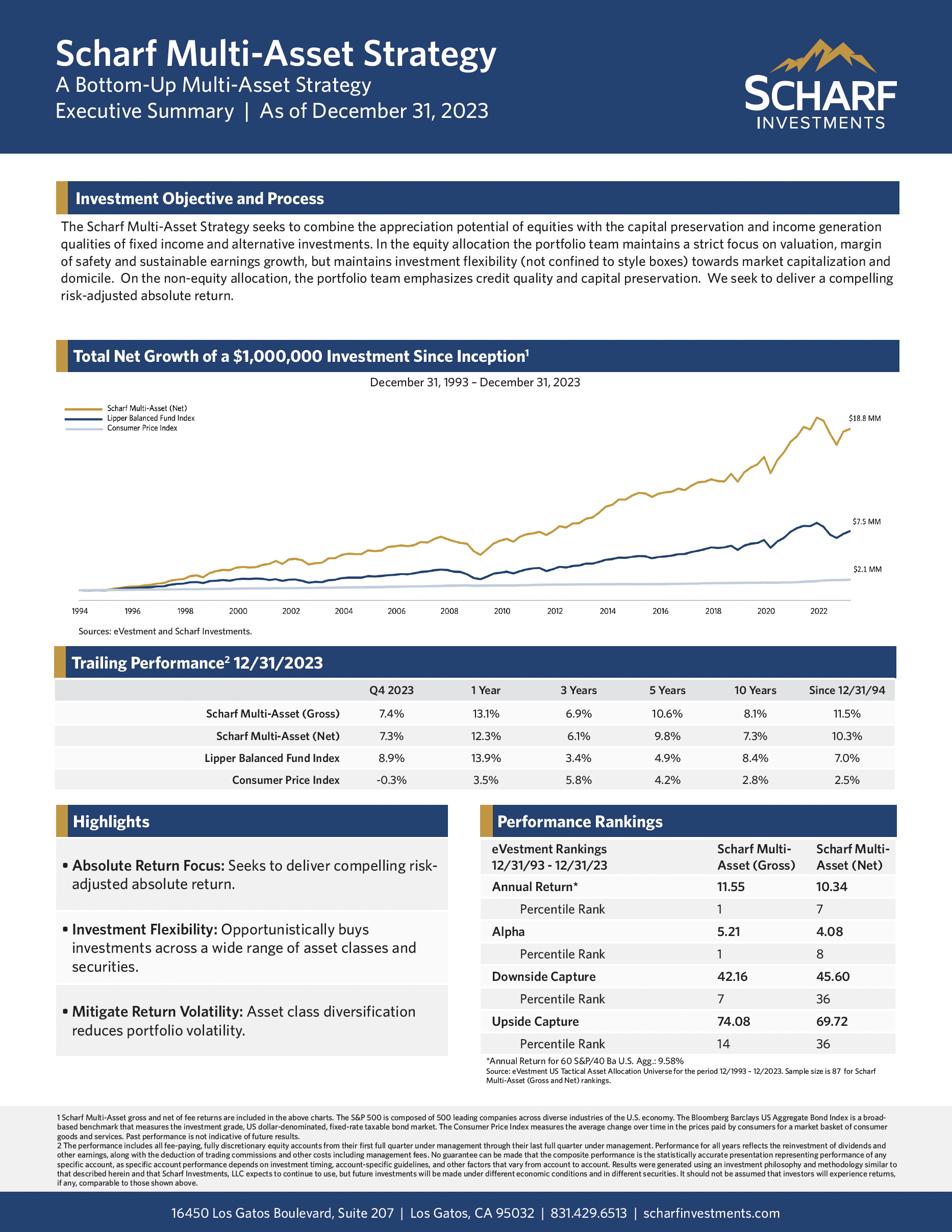

Scharf Multi-Asset Strategy Q4’23

December 31, 2023 | Brochures

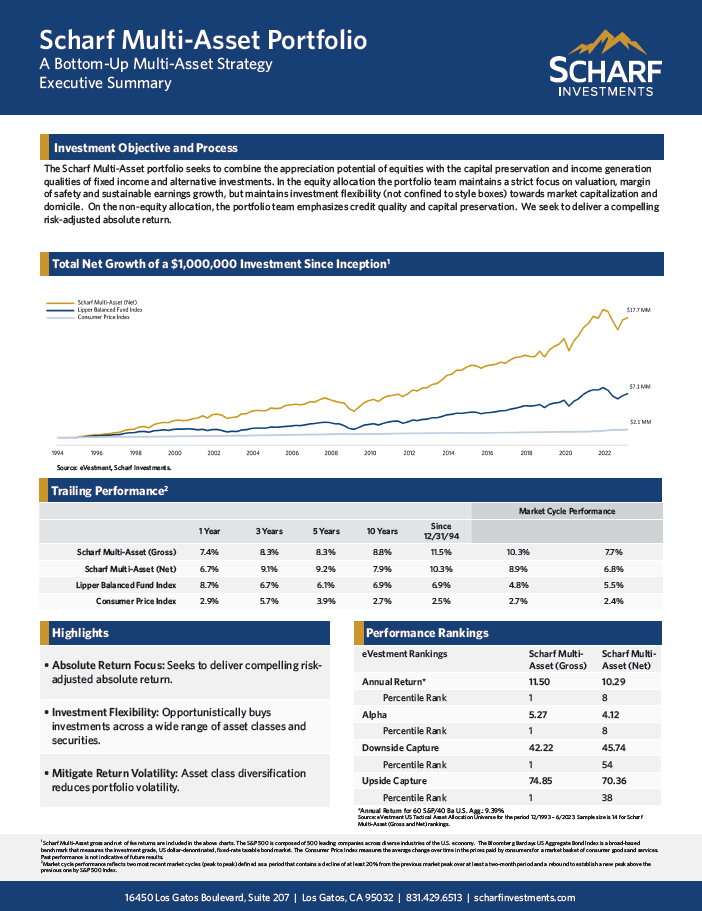

The Scharf Multi-Asset Strategy seeks to combine the appreciation potential of equities with the capital preservation and income generation qualities of fixed income and alternative investments. In the equity allocation the portfolio team maintains a strict focus on valuation, margin of safety and sustainable earnings growth, but maintains investment flexibility (not confined to style boxes) towards market capitalization and domicile. On the non-equity allocation, the portfolio team emphasizes credit quality and capital preservation. We seek to deliver a compelling risk-adjusted absolute return.

-

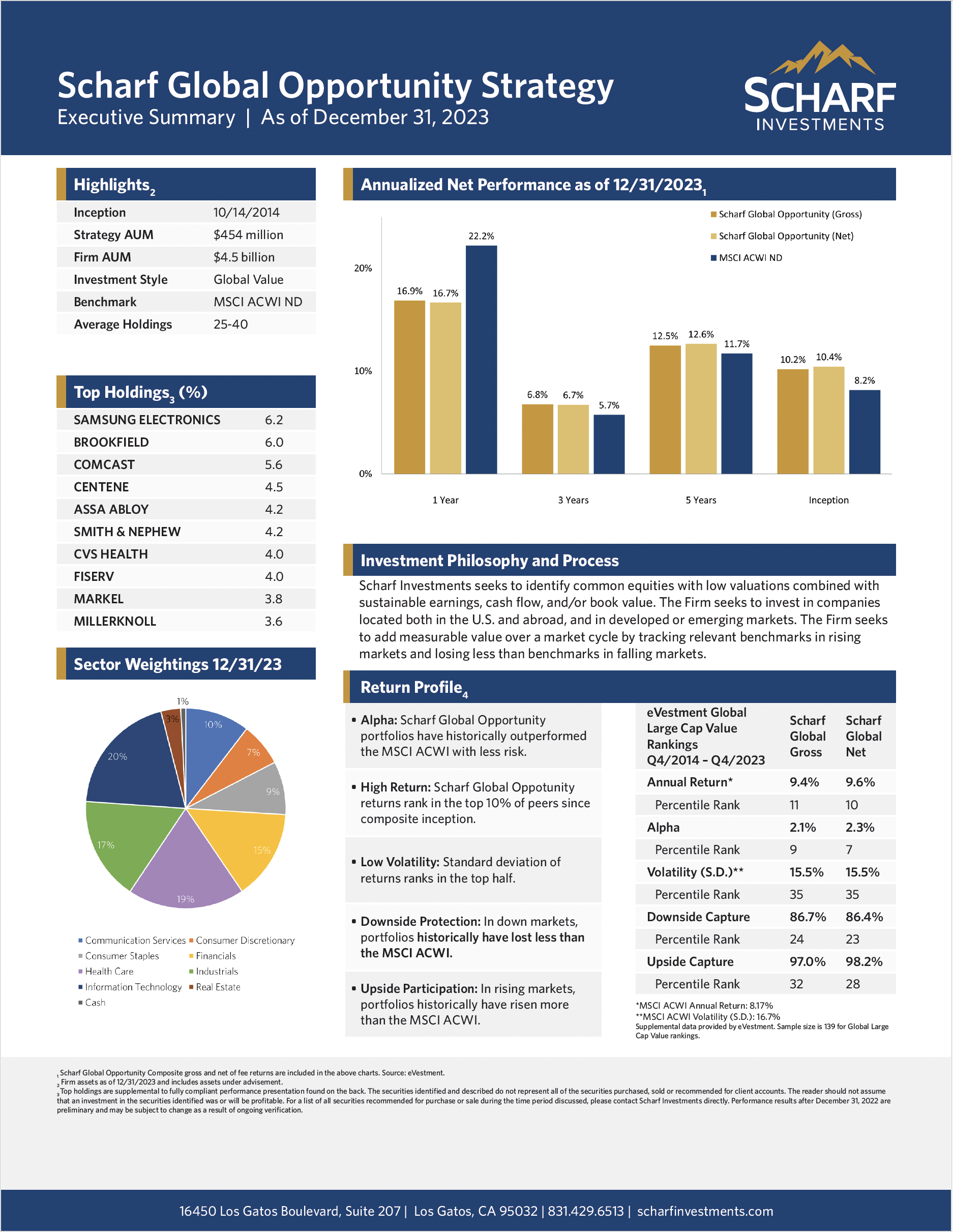

Scharf Global Opportunity Strategy Q4’23

December 31, 2023 | Brochures

Scharf Investments seeks to identify common equities with low valuations combined with sustainable earnings, cash flow, and/or book value. The Firm seeks to invest in companies located both in the U.S. and abroad, and in developed or emerging markets. The Firm seeks to add measurable value over a market cycle by tracking relevant benchmarks in rising markets and losing less than benchmarks in falling markets.

-

Scharf Mutual Funds

December 31, 2023 | Brochures

-

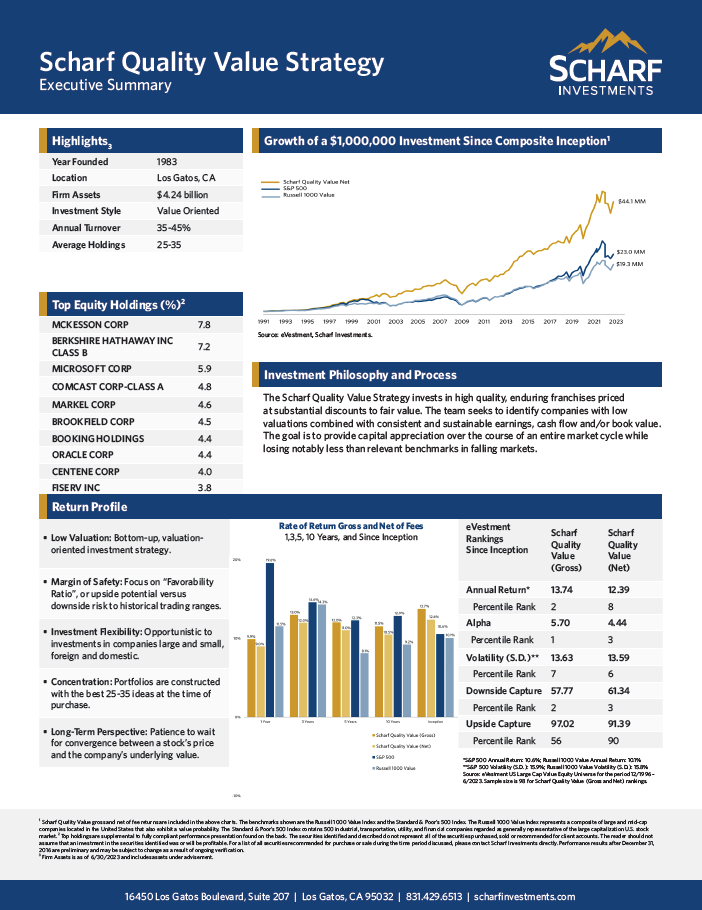

Scharf Quality Value Strategy

September 30, 2023 | Brochures

The Scharf Sustainable Value Strategy seeks to identify common equities with low valuations combined with growing earnings, cash flow and/or book value. The portfolio team maintains a strict focus on valuation, margin of safety and consistent earnings growth, but maintains investment flexibility (not confined to style boxes) towards market capitalization and domicile. We seek to add measurable value to client accounts over the course of a market cycle while losing notably less than relevant benchmarks in falling markets.

-

Scharf Multi-Asset Strategy

September 30, 2023 | Brochures

The Scharf Multi-Asset portfolio seeks to combine the appreciation potential of equities with the capital preservation and income generation qualities of fixed income and alternative investments. In the equity allocation the portfolio team maintains a strict focus on valuation, margin of safety and consistent earnings growth, but maintains investment flexibility (not confined to style boxes) towards market capitalization and domicile. On the non-equity allocation, the portfolio team emphasizes credit quality and capital preservation. We seek to deliver a compelling risk-adjusted absolute return.